inheritance tax wisconsin rates

However like every other state Wisconsin has its own inheritance laws including what happens if the decedent dies without a valid will. Brief History of the Inheritance Tax Rates in Wisconsin Download eBook Read Pdf-ePub-Kindle Download full pdf book Brief History of the Inheritance Tax Rates in Wisconsin by Anonim available in full 6 pages and make sure to check out other latest books Inheritance and transfer tax related to Brief History of the Inheritance Tax Rates in Wisconsin below.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate planning can bring unexpected challenges so it may make sense to get a professional to help you.

. Policy Issues Influencing the Inheritance Tax Some of the major public policy issues related to the inheritance tax emerged soon after Sanderson. One reason is because states dont levy the inheritance tax on spouses or direct descendents including children and grandchildren. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40.

If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706. There is no Wisconsin inheritance tax for decedents dying on or after January 1 1992. The Federal estate tax only affects02 of Estates.

56 million West Virginia. No estate tax or inheritance tax. One reason is because states dont levy the inheritance tax on spouses or direct descendents including children and grandchildren.

The top estate tax rate is 16 percent exemption threshold. Wisconsin tax structure. If death occurred prior to January 1 1992 contact the Department of Revenue at 608 266-2772 to obtain the appropriate forms.

You can do it right here in Wisconsin. The graduated tax rates ranged from 18 to 55. Tips for Mitigating Inheritance Taxes.

Wisconsin Gift Tax Return. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. In general its rare to owe a huge tax on inherited property.

Wisconsin also has a sales tax between 5 to 6 and counties can leverage an additional 1 to 2 on top of that. Income tax rates in Wisconsin range from 400 to 765. Its a great reason to live in the state of Wisconsin and even spend your final days in the state of Wisconsin.

Wisconsin state income tax rates range up to 765. In more simplistic terms only 2 out of 1000 Estates will owe Federal Estate Tax. There is no Wisconsin.

Inheritance tax rules vary by state and can get complex. Surviving spouses are always exempt. Tips for Mitigating Inheritance Taxes.

Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. All inheritance are exempt in the State of Wisconsin. But you dont have to go to Florida to avoid the state estate tax.

There is no Wisconsin gift tax for gifts made on or after January 1. Learn Wisconsin tax rates for property sales tax and more to estimate how much you will pay on your 2021 taxes. Keep reading for all the most recent estate and inheritance tax rates by state.

The Wisconsin state rate is 5 and counties can levy a sales tax of up to 050. To Wisconsin Statutes Administrative Rules Wisconsin Tax Bulletins ISE Publications and. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as.

Maryland is the only state to impose both. In 2022 the federal estate tax generally applies to. Twelve states and Washington DC.

In general its rare to owe a huge tax on inherited property. This number doubles to 224 million for married couples. Income tax rates average from 4 to 8.

Homeowners with total household. Heres difference between Estate and Inheritance Tax. There are NO Wisconsin Inheritance Tax.

Impose estate taxes and six impose inheritance taxes. Additionally the new higher. The sales tax rates in Wisconsin rage form 500 to 550.

Key findings A federal estate tax ranging from 18 to 40. However the top graduated tax rate was reduced to 50 for 2002 with annual decreases of 1 thereafter through 2007. Inheritance tax rules vary by state and can get complex.

But rates or very existence of Estate or Inheritance Tax within specific states varies wildly. Wisconsin does not have a state inheritance or estate tax. Capital Gains Tax 2021 and 2022 Rates.

GENERAL TOPICAL INDEX. Estate taxes are based on value of the deceaseds property only apply if estate exceeds exemption and are paid before money is distributed to heirs. The occasion was the 1898 report of the Wisconsin State Tax Commission Commission 3 a state agency that then consisted of the governor the secretary of state and three.

In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. Florida is a well-known state with no estate tax as well. Tax rates can change from one year to the next.

The top marginal rate was 46 for 2006 and is 45 for 2007 through 2009. Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier. Wisconsin has among the highest property tax rates in the nation.

Marital property includes assets a married couple acquires after their determination date which is the couples marriage date the date they began residing in wisconsin or january 1 1986 whichever is later. The property tax rates are among some of the highest in the country at around 2. State inheritance tax rates range from 1 up to 16.

Wisconsin is a moderately tax friendly state. No estate tax or inheritance tax. Capital Gains Tax 2021 and 2022 Rates.

Wisconsin Inheritance Tax Return. No estate tax or inheritance tax. This is consistent with national averages.

The average effective rate is 195. Anyone who gets more than that has to pay a tax rate of up to 40 percent on the excess. As provided under EGTRAA all of the rates except those at the top remain the same as they were under prior law.

Washington DC District of Columbia. But currently Wisconsin has no inheritance tax. Whats new for Estate Taxes in 2022.

The annual gift tax exclusion amount jumps to 16000 for 2022 up from 15000 where it sat since 2018. In 2022 an individual can leave 1206 million to their heirs without paying any federal estate or gift tax. Married couples can avoid taxes as long as the estate is valued at under 2412 million.

INHERITANCE AND ESTATE TAX. People who receive less than 112 million as part of an estate can exclude all of it from their taxes. Wisconsin Inheritance and Gift Tax.

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Nightlife Travel

Is There A Federal Inheritance Tax Legalzoom Com

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Gift Tax Explained 2022 And 2021 Exemption And Rates Smartasset

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Estate Tax Inheritance Tax Arizona Real Estate

Do I Pay Taxes On Inheritance Of Savings Account

States With Highest And Lowest Sales Tax Rates

100 Best Places To Retire The Sunbelt Rules Once Again In 2013 Best Places To Retire Retirement Community Best Places To Live

What Is The Estate Tax And How Does It Work Wisconsin Business Attorneys Wausau Eau Claire Green Bay

Irs Announces Higher 2019 Estate And Gift Tax Limits

States With No Estate Tax Or Inheritance Tax Plan Where You Die

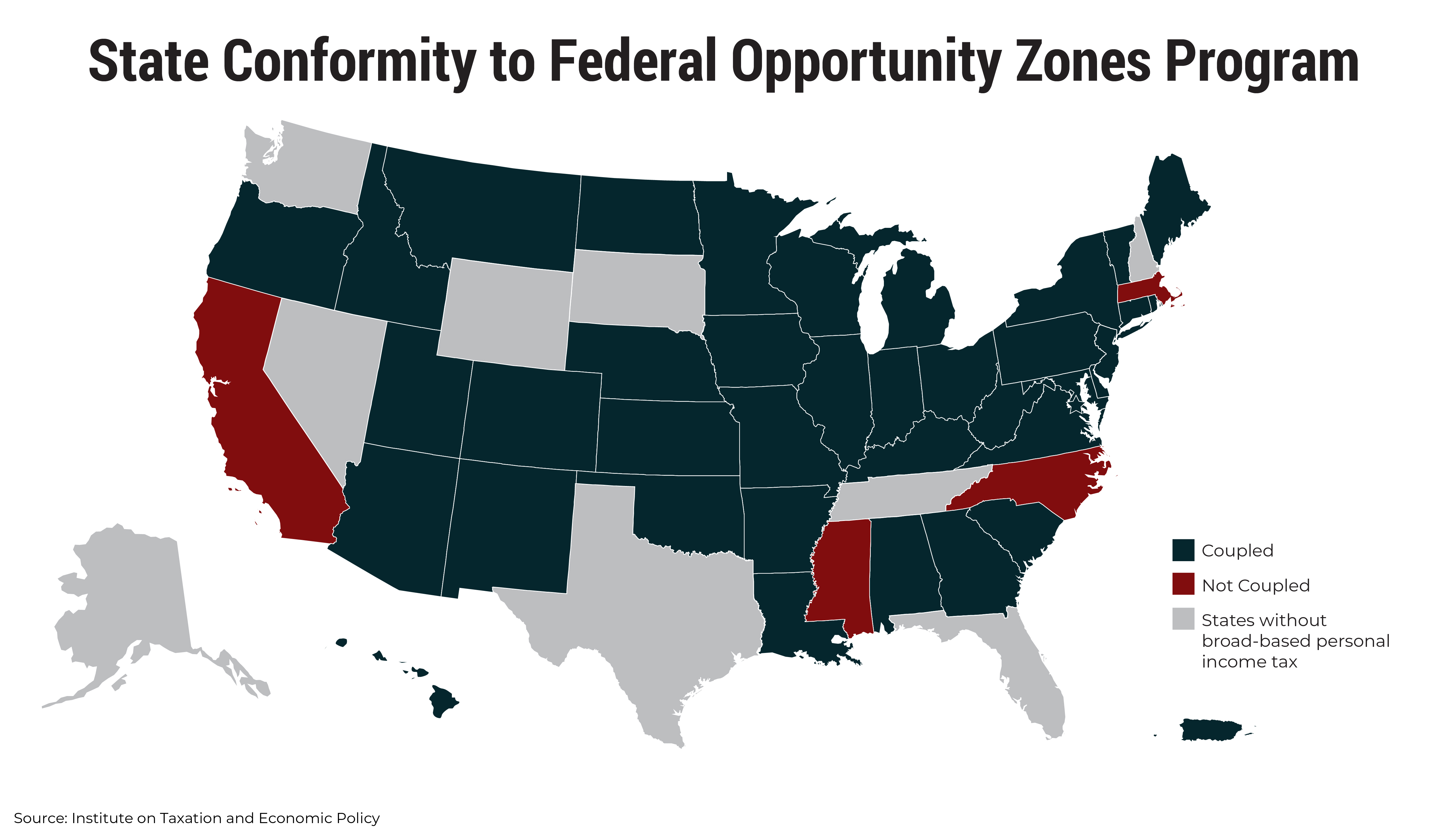

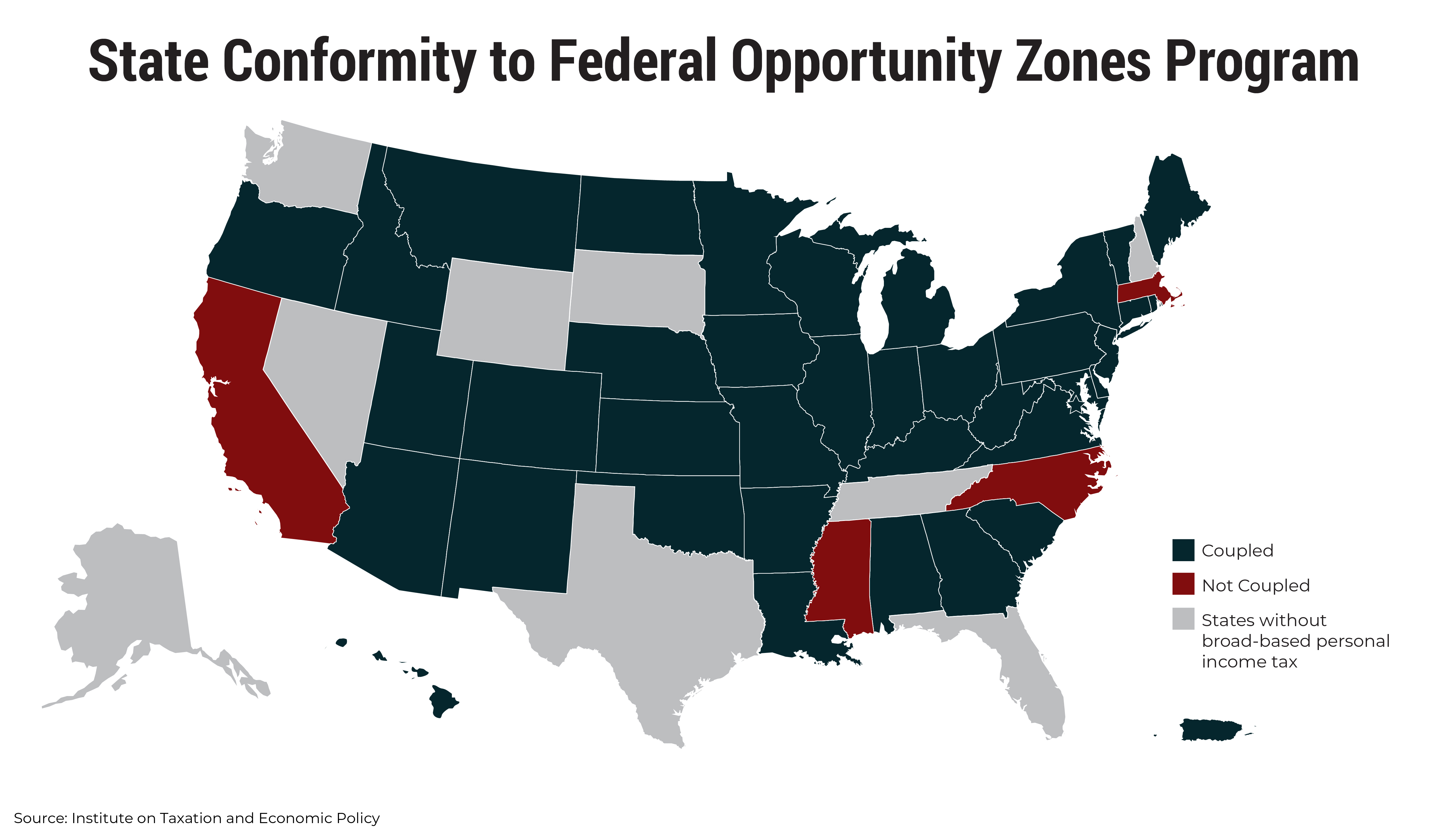

States Should Decouple From Costly Federal Opportunity Zones And Reject Look Alike Programs Itep

/State_corporate_tax_rate-d913771f47104ed6a746341ed611ce54.jpg)